Pradhan Mantri Awas Yojana Subsidy Calculator? Home Loan

The Pradhan Mantri Awas Yojana (PMAY), a central government initiative, is proving to be highly beneficial for Indian citizens who do not own a home. By applying for this scheme, individuals can take advantage of the PMAY subsidy calculator to understand how they can make homeownership more attainable with government aid.

The scheme is divided into two parts: PMAY-G (Pradhan Mantri Gramin Awas Yojana) for rural areas and PM Awas Yojana Urban for urban regions. Under these segments, beneficiaries can use the Pradhan Mantri Awas Yojana subsidy calculator to calculate the financial aid they will receive, enabling them to build or purchase a home with support from the government.

The Pradhan Mantri Awas Yojana home loan subsidy calculator is particularly beneficial for economically weaker sections, low-income groups, and middle-income groups, allowing them to secure affordable housing. This PMAY home loan calculator significantly reduces the financial burden on these groups, helping them achieve their dream of homeownership.

Additionally, the CLSS subsidy calculator is a crucial tool for those seeking to benefit from the Credit Linked Subsidy Scheme under PMAY. This initiative not only provides a housing subsidy calculator but also stimulates construction activity and creates job opportunities across rural and urban areas, driving economic growth.

By leveraging these tools like the PMAY eligibility calculator and PMAY loan calculator, citizens can better understand their potential benefits. These calculators, such as the CLSS Awas calculator and the PM Awas Yojana EMI calculator, empower individuals to plan their finances effectively and ensure they meet the requirements to receive the 2.67 lakh subsidy on home loan calculator benefits.

The government aims to ensure that every citizen has access to a safe and durable dwelling, thereby improving the overall quality of life. The PMAY calculator and PM Awas Yojana loan calculator are designed to support this vision, ensuring that financial assistance is accessible to those who need it most.

This initiative is part of the broader vision of the Government of India to eliminate housing insecurity and improve living standards, aligning with the country’s commitment to inclusive growth and sustainable development. Tools like the PMAY subsidy calculation formula and subvention calculator are vital in achieving this goal, providing transparency and ease in accessing benefits.

In this article, I will provide you with a detailed guide on how to extract PM Awas SECC Family Member Details. By following these steps, you can easily access the necessary information without encountering any difficulties. Whether you’re doing this for personal reference or to assist someone else, this comprehensive guide will ensure that you navigate the process smoothly and efficiently.

PMAY Subsidy Calculator

Under the Pradhan Mantri Awas Yojana (PMAY) scheme, beneficiaries can receive a subsidy on home loan interest rates through the Credit-Linked Subsidy Scheme (CLSS). This subsidy is determined by the beneficiary’s income category and the loan amount.

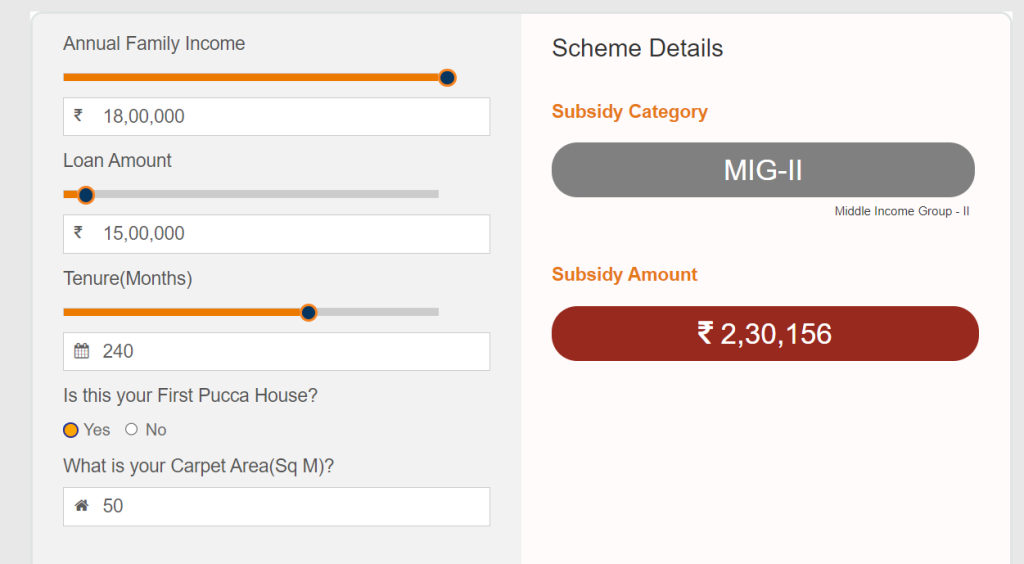

To calculate your PMAY subsidy, follow these steps:

- Visit the official website: https://pmayuclap.gov.in/.

- The homepage of the PMAY UCLAP (Urban Credit Linked Subsidy Scheme) will appear.

- Click on the “Subsidy Calculator” option available on the homepage.

- The CLSS Awas Portal (CLAP) subsidy calculator page will open.

- Enter your details such as Annual Family Income, Loan Amount, Tenure (Months), Carpet Area, etc., to calculate your eligible subsidy.

By following these steps, you can easily estimate the subsidy amount you are entitled to under the PMAY scheme.

Subsidy Rates as per Income Group

For the Economically Weaker Section (EWS) and Low Income Group (LIG) under the Pradhan Mantri Awas Yojana (PMAY), here are the key details:

- Income Range: ₹3 lakh to ₹6 lakh per annum

- Subsidy Rate: 6.5% on the interest rate

- Maximum Loan Amount: ₹6 lakh

- Maximum Loan Tenure: 20 years

💡 Example: If an individual takes a home loan of ₹6 lakh at a subsidy rate of 6.5% for a tenure of 20 years, they can receive an interest subsidy of up to ₹2.67 lakh. This significant subsidy reduces the overall burden of the loan, making homeownership more affordable for those in the EWS/LIG category.

MIG-I (Middle Income Group-I):

For individuals with an income range of ₹6 lakh to ₹12 lakh per annum under the Pradhan Mantri Awas Yojana (PMAY), the details are as follows:

- Income Range: ₹6 lakh to ₹12 lakh per annum

- Subsidy Rate: 4% on the interest rate

- Maximum Loan Amount: ₹9 lakh

- Maximum Loan Tenure: 20 years

💡 Example: If someone takes a home loan of ₹9 lakh at a subsidy rate of 4% for a tenure of 20 years, they can receive an interest subsidy of up to ₹2.35 lakh. This subsidy helps reduce the overall cost of the loan, making it easier for individuals in this income bracket to achieve homeownership.

MIG-II (Middle Income Group-II):

For individuals with an income range of ₹12 lakh to ₹18 lakh per annum under the Pradhan Mantri Awas Yojana (PMAY), the details are as follows:

- Income Range: ₹12 lakh to ₹18 lakh per annum

- Subsidy Rate: 3% on the interest rate

- Maximum Loan Amount: ₹12 lakh

- Maximum Loan Tenure: 20 years

💡 Example 1: If a person takes a home loan of ₹12 lakh at a subsidy rate of 3% for a tenure of 20 years, they can receive an interest subsidy of up to ₹2.30 lakh. This subsidy effectively reduces the overall interest burden, making it easier to manage the loan repayment.

💡 Example 2: Let’s say you fall under the Economically Weaker Section (EWS) category and have taken a loan of ₹6 lakh for a tenure of 20 years. With an interest rate subsidy of 6.5%, you would be eligible for a total subsidy of ₹2.67 lakh. This amount is deducted from your original loan, thereby reducing your Equated Monthly Installments (EMIs) and making homeownership more affordable for you.

| Particulars | Economically Weaker Section | Lower Income Group | Middle Income Group 1 | Middle Income Group-2 |

| Maximum Carpet Area | 30 sq.m. | 60 sq.m. | 160 sq. m | 200 sq. m |

| Annual Family Income | Above 3 Lakh | 3 lakh to 6 lakh | 6 lakh to 12 lakh | 12 lakh to 18 lakh |

| Subsidy on home loan interest rate | 6.50% | 6.50% | 4.00 % | 3.00 % |

| Loan amount for interest subsidy | 6 lakhs | 6 lakhs | 9 lakhs | 12 lakhs |

| Maximum home loan repayment tenure | 20 years | 20 years | 20 years | 20 years |

| Maximum interest subsidy amount | Rs. 2,67,280 | Rs. 2,67,280 | Rs 2,35,068 | Rs 2,30,156 |